2015/11/05

No. 220: Toshiya Tsugami, "The CHY issue becomes a global risk"

On top of the continuing economic slowdown, recent news of the stock bubble collapse and the Chinese Yuan (CHY) devaluation has further exacerbated disquiet about the Chinese economy.

China's economic growth rate has perhaps already dipped below seven per cent, but the Xi Jinping administration is unlikely to kick off a large-scale economic stimulus because the administration is aware that the investment-led economic growth model has already reached its limit. According to official statistics, cumulative "fixed asset investments" from 2009 to 2014 - comprising capital investment in the manufacturing sector, real estate investment and infrastructure investment by governments - already exceed 200 trillion CHY (roughly 31 trillion USD).

Not all industrial sectors and regions are in bad shape; industries relating to service, consumption and IT are still growing fast. If the administration can properly encourage further growth in these sectors, then they will become the new engines for future economic growth (but the opposite is also true). In any case, however, such bright spots in the economy are not large enough to replace the slowdown in investment.

The Chinese economy is unlikely to return to robust growth over the next five to ten years. This is a "new normal" that the rest of the world needs to face squarely. There are still voices abroad calling for a large stimulus package, but the Xi administration will not accede to this request. Even if it were to do so, we would need to anticipate a hard landing sooner or later.

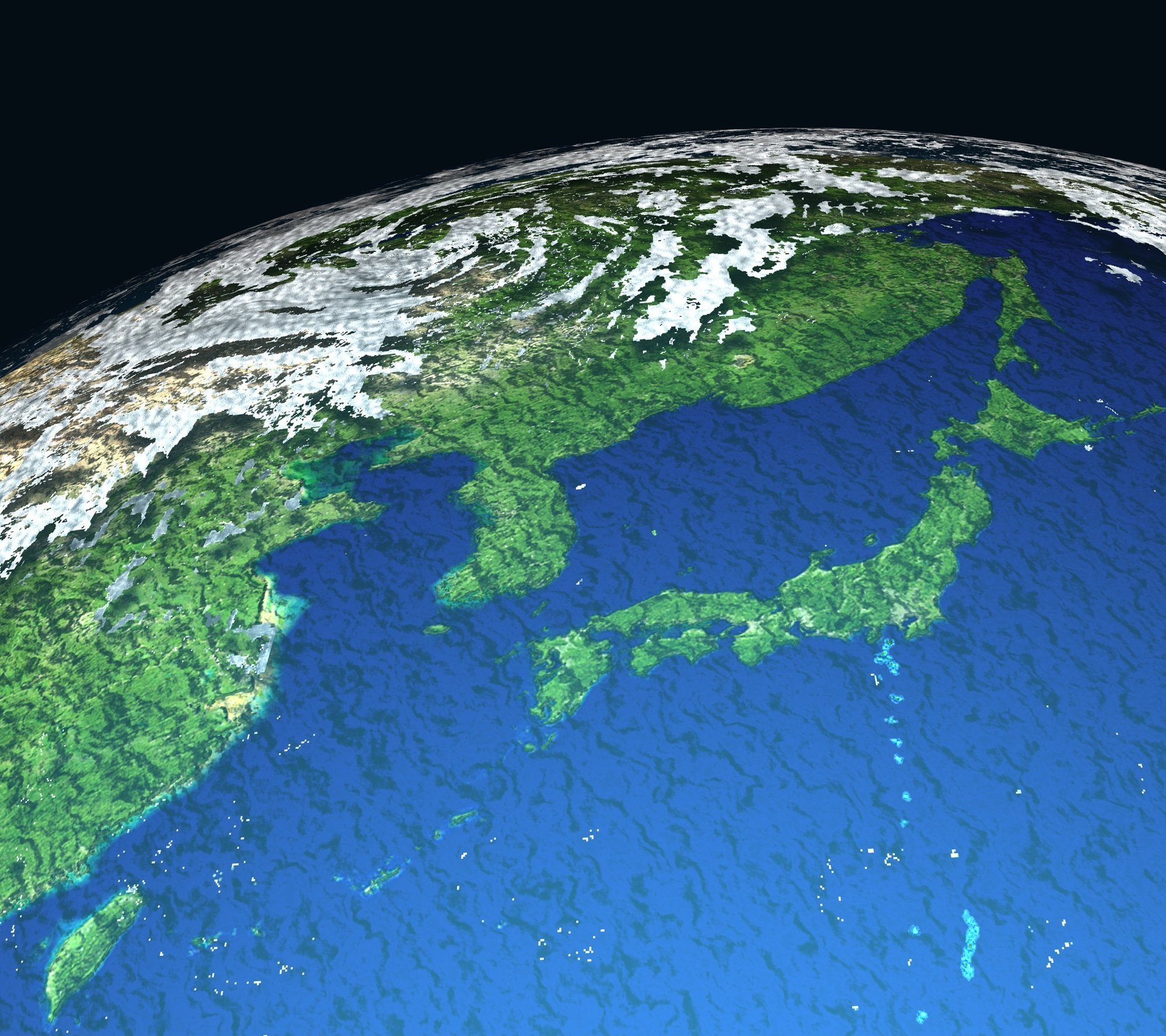

The fact that the Chinese economy faces such problems does not necessarily mean that China will suffer most. For better or worse, the government's power to influence the economy is much stronger in China than in other countries. Thus it is more likely that neighboring Southeast and Northeast Asian countries as well as resource-producing countries will suffer more.

On 11th August, the People's Bank of China ("PBoC"; China's central bank) announced that it had revamped the CHY exchange rate mechanism and guided the CHY-USD rate downward for three consecutive days. Most media reports that this was an injection of cheap CHY meant to drive exports were wrong. Evidence shows that this was actually a response to the International Monetary Fund (IMF)'s suggestion that the CHY regime be reformed and that CHY rates be allowed to move more freely. China did so in order to let the CHY play a major international role.

Both the IMF and the PBoC overlooked one fact, however. While the CHY has long been undervalued and is anticipated to rise in future, China's recent and significant monetary easing, the astronomical amount of ineffective investments and soaring labor costs have considerably weakened the value of the CHY. As a result, both Chinese enterprises and individuals now anticipate that the CHY will fall in future and prefer holding USD to CHY since last year.

The PBoC's revamping was carried out under such circumstances and was viewed as an injection of cheap CHY, which then prompted large-scale speculative bets on CHY devaluation in the market. Last August and September, China's foreign currency reserves fell by 94 billion USD and 43 billion USD respectively, presumably as a result of PBoC market intervention designed to prevent the CHY from falling.

Maintaining a relatively high exchange rate seems to be rather tough for the current Chinese economy and, taking into account China's contribution to global economic growth, allowing the CHY to take a breather and devaluate by ten to twenty per cent might even be beneficial for the entire global economy.

Once this happens, though, developing countries and emerging economies might then be faced with devaluation dominoes, and some of them might fall into a currency crisis. Instead, if we demand that China stabilize CHY exchange rates, then it might need to sell off USD-denominated bonds, including US treasury bills, in order to intervene in the currency market.

The US Federal Reserve Board (FRB) has acquired 3.5 trillion USD in bonds since the Lehman Shock and, over that same period, the PBoC has picked up another 2 trillion USD in foreign denominated bonds for a total of 3.6 trillion USD, of which more than half is USD-denominated. If the PBoC sells these bonds in haste, then it would risk triggering a bond price collapse, which would mean a sudden interest rate rise. In a sense, the PBoC has now become a "shadow FRB" that can influence US interest rates. This is something that the world has not confronted before. After the coming US interest rate rise and the Chinese economic slowdown, this CHY issue is the third greatest risk that the global economy faces today.

Toshiya Tsugami is the President of a Tsugami Workshop Ltd.,. After graduated from Tokyo University in 1980, Tsugami served for the Ministry of Economy, Trade and Industry (METI) and experienced China's WTO entrance negotiation, Economic Counselor of the Embassy in Beijing and Director for Northeast Asia of METI. He is now working as an independent China business consultant and is also one of the most famous China Economy experts in Japan.

The views expressed in this piece are the author's own and should not be attributed to The Association of Japanese Institutes of Strategic Studies.